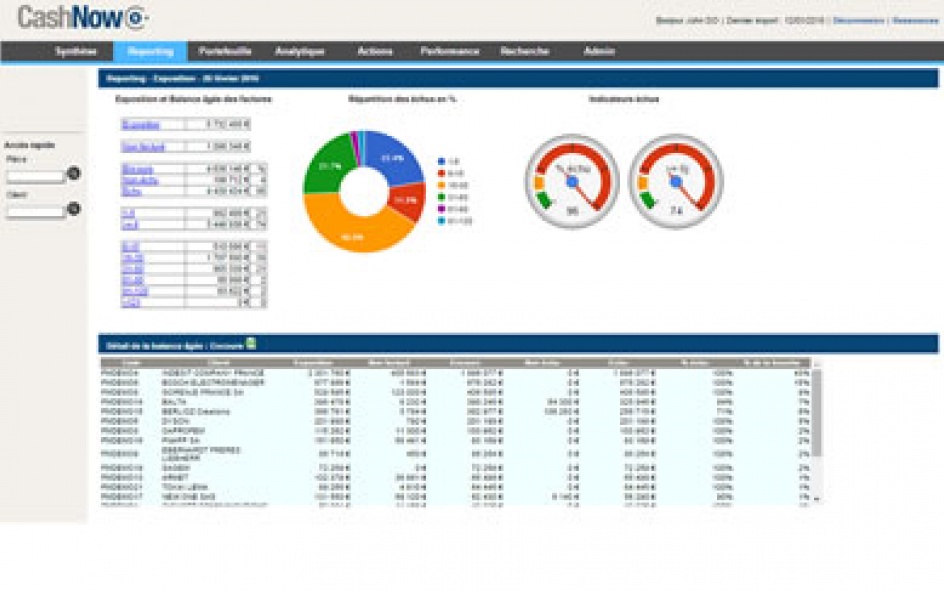

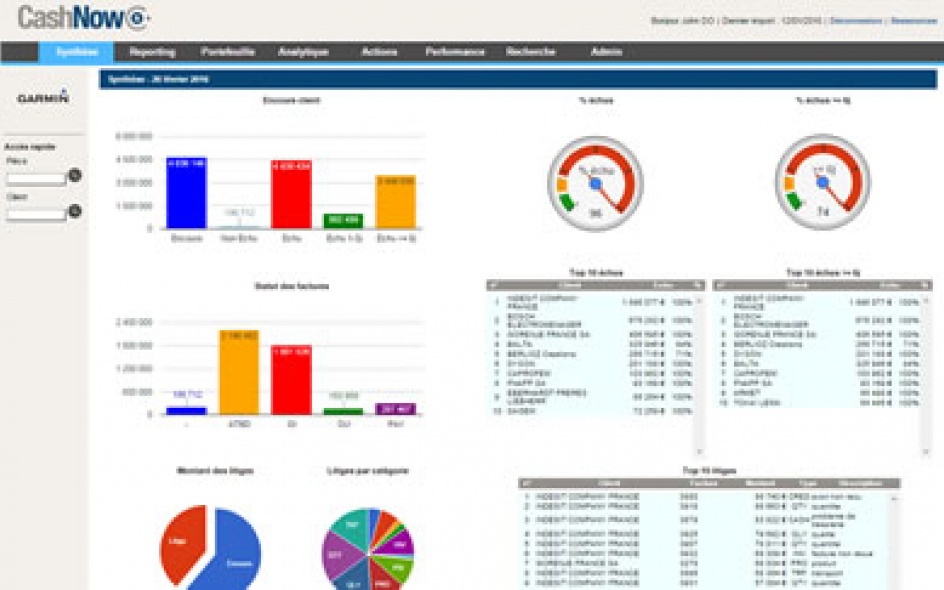

CashNow Connect, a collaborative and intelligent solution for managing the account receivables.

Versatility and expertise, an innovative approach for any type of organization

Collaborative

The exchanges are reinforced between people

Fast

Efficient

Smart

Mobile

Intuitive

Increased productivity

- Detection of the risks of non-payment

- Automation of tasks

- Planning and prioritization of actions

- The placing under control of outstanding customers

- Credit and risk management

Additional modules adapted to your activity and your organization

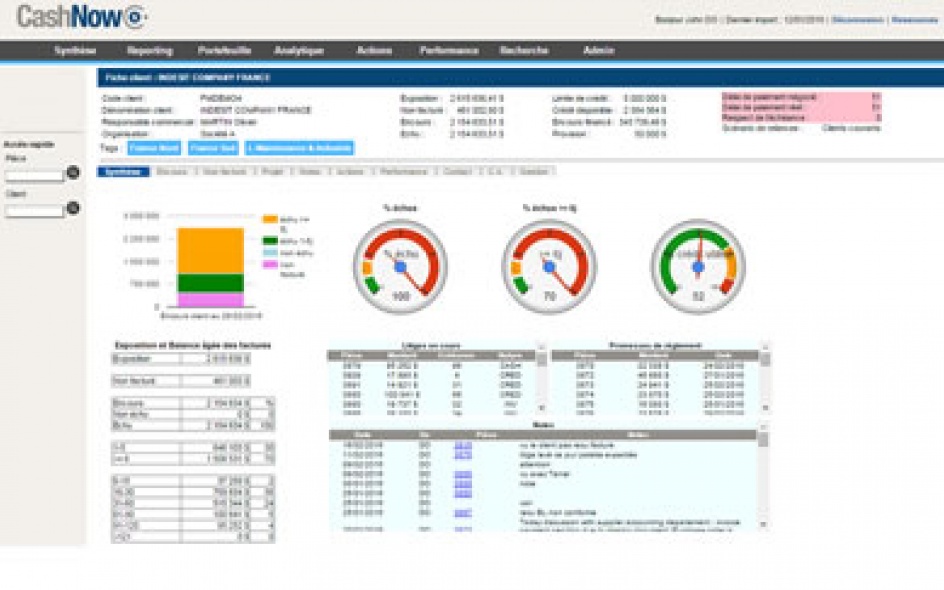

The customer credit risk does not begin with the invoicing but from the order taking and the concretization of the services (manufacturing, shipping, delivery, advices, etc).

How can you manage your risk and speed up your billing?

The "Unbilled Management" module is used to manage the upstream billing by integrating the flow of forecasts, orders and invoices to be established in CashNow Connect: thanks to its functionalities, all stakeholders interact in real time for efficient billing.

These features allow:

- Detection of billing delays

- Identification of non-billing causes and sources of litigation (incomplete documentation, for example)

- Implementation of actions to speed up the billing process

- Comprehensive risk management with the integration of the unbilled in the monitoring of credit limits, and the complete vision of customer and project risk

- Information sharing between sales representatives, sales administration and credit management

- Billing forecast

The module "Unbilled Management" is relevant in many activities: manufacturing industry, services, distribution and computer integration, software, etc.

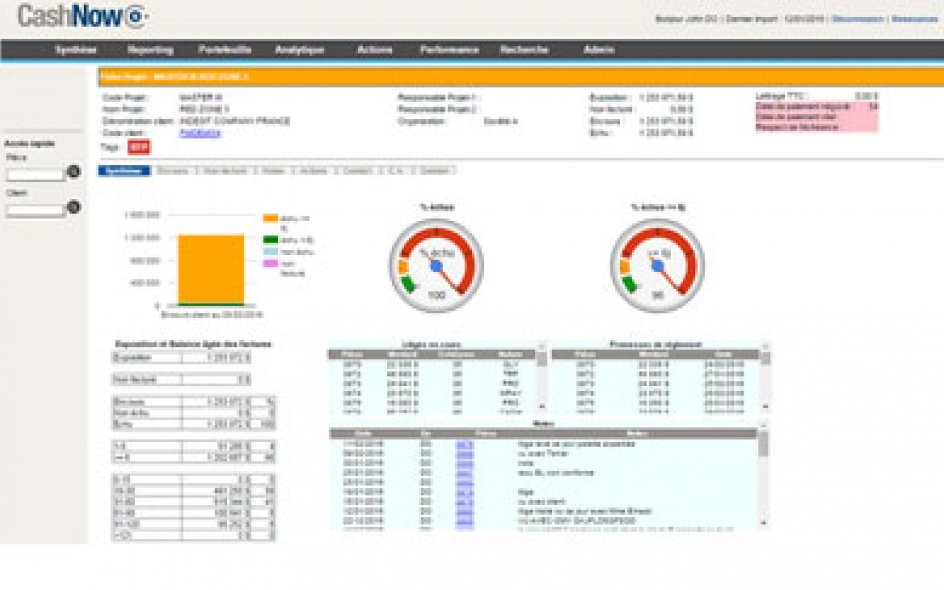

Your activity is structured around the notion of project ? Your AR are broken down into several projects, which may involve different customers ?

How to distinguish projects in your AR, for risk management and effective cash collection ?

The "Project Management" module allows you to manage your customer risk (unbilled and billed) according to the project and project group analysis axis. These features allow:

- Sharing adequate and targeted information with your sales organization (sales team, project manager, and sales administration)

- Analysis of the contribution of each project to cash: over or under billing

- Targeting collection actions

The "Project Management" module is relevant in many activities working with the project axis, including: BTP, consulting, IT services, distribution and solution integration, energy.

Your organization is global or local, multi-site, multi-country?

The "Organization Management" module is used to manage organizations of different sizes, located locally or internationally.

These features allow:

- To manage several geographical or functional organizations, and thus allow a detailed and consolidated view of the client's risk

- To Manage different currencies with ease and benefit from consolidation in the currency of your choice with one click

- To offer a multilingual interface to your users